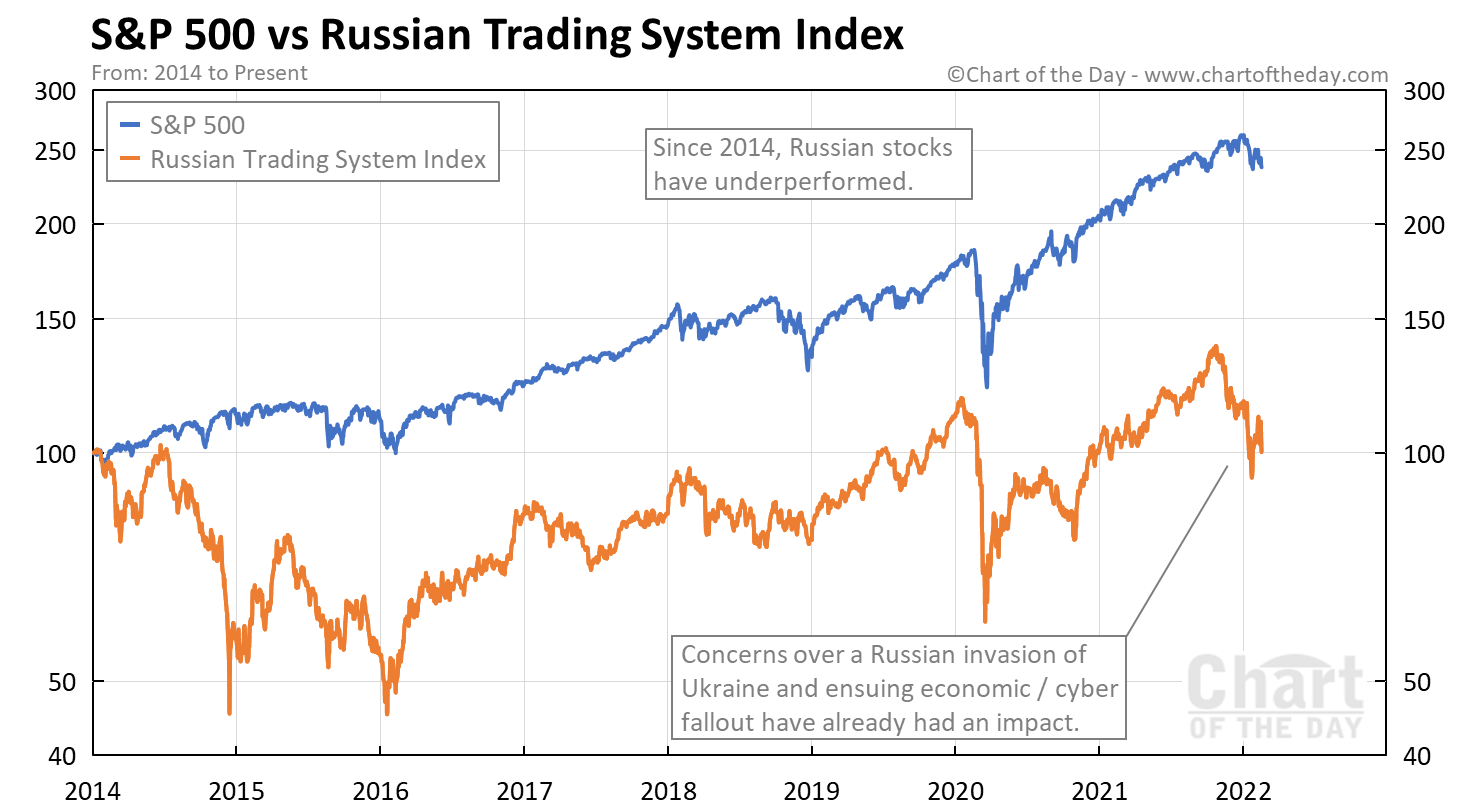

As concerns over a potential Russian invasion of Ukraine grow, today’s chart takes a look at the impact all of this has had on two markets — the U.S. and Russian stock market.

Russia invaded and annexed Crimea back in early 2014 and began what has become a multi-year effort to control Ukraine.

While there are many factors that can impact the stock market over the long-term, the fact that the Russian stock market (as measured by the Russian Trading System Index) trades at the same level it did back in 2014 suggests that their initial incursions have not been a boon for their stock market.

More recently, as Russian troops amassed along the Ukrainian border, threats of significant economic sanctions have weighed.

As for the U.S…

When you consider that the U.S. is grappling with an elevated inflation rate and resulting concerns over a quick rise in interest rates, the impact of the Russia-Ukraine crisis on U.S. markets to date has been relatively mild.

What is Russia's stock market called?

Russia’s largest stock exchange is called the Moscow Exchange.

What is the inception date of Russian Trading System Index?

The Russian Trading System Index begins on September 1, 1995.

How is the Russian Trading System Index calculated?

The Russian Trading System Index is a capitalization-weighted index.

How many stocks are in the Russian Trading System Index?

The Russian Trading System Index is comprised of 50 of the most liquid Russian stocks.