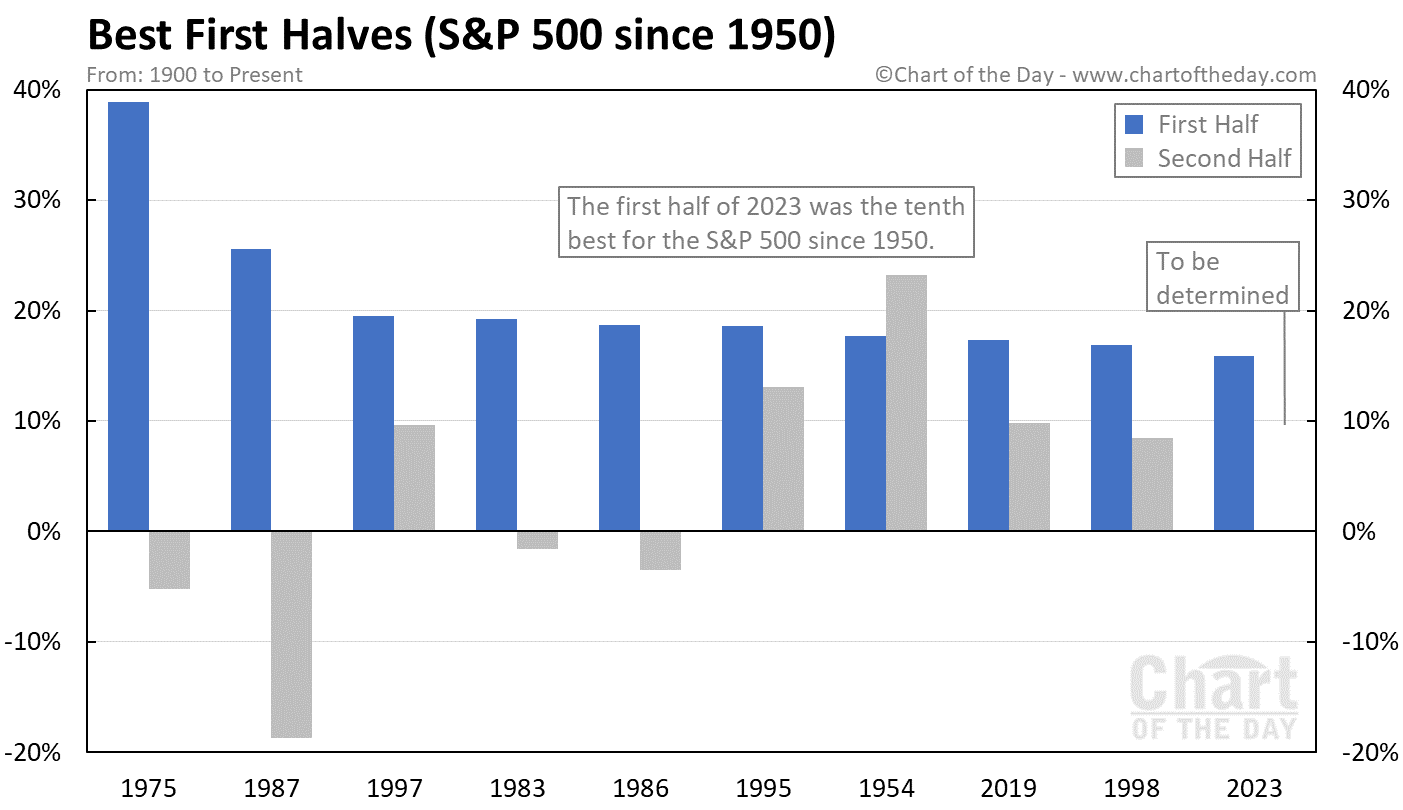

For stocks, the first half of 2023 has been positive.

In fact, the S&P 500 was up 15.9% during the first half of 2023.

So how does this first half compare?

To answer that question, today’s chart presents the best first halves for the S&P 500 since 1950 (blue columns).

Conclusion…

This is the tenth best first half for the S&P 500 since 1950.

It is worth noting that a majority of first halves illustrated on today’s chart were followed by second halves (gray columns) that were somewhat less robust.