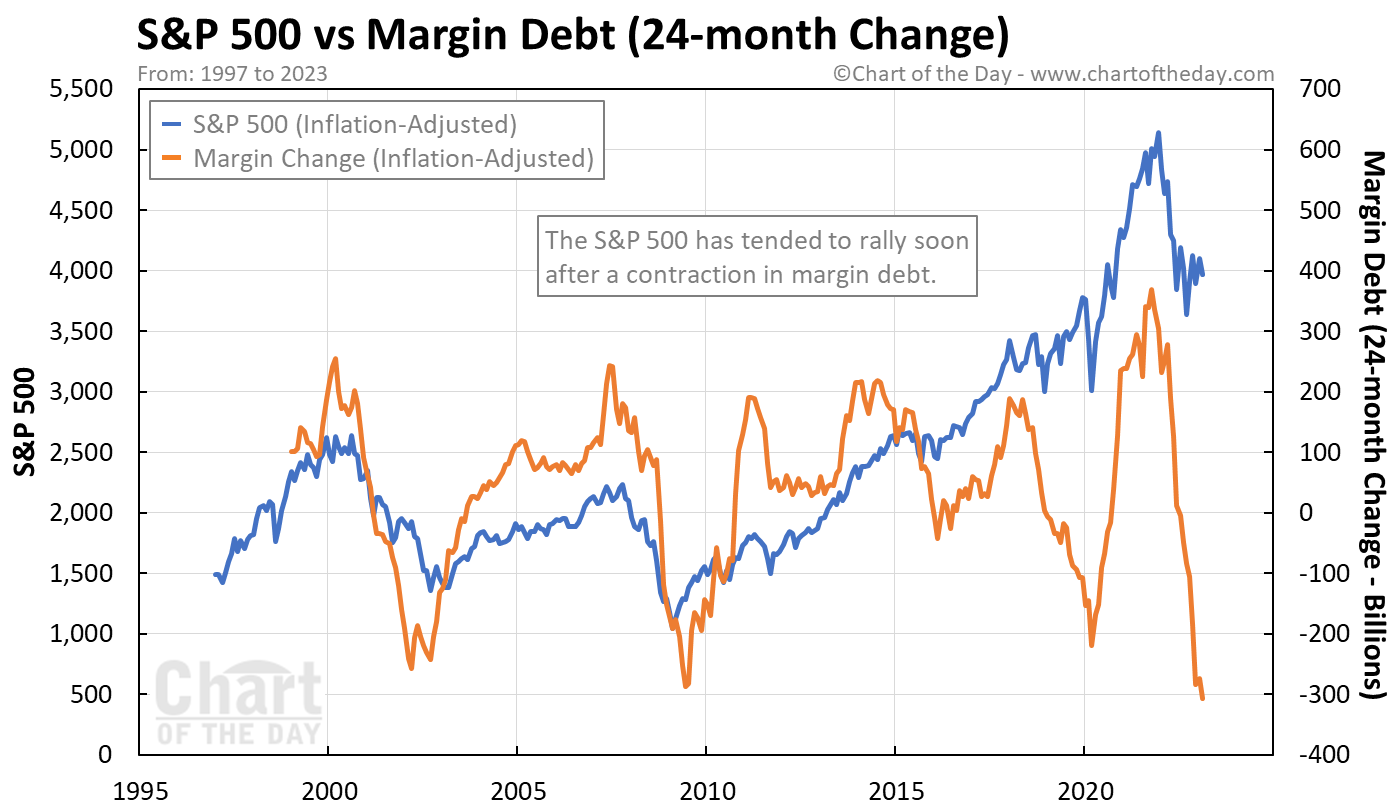

The recent rise in interest rates has encouraged investors to take on less margin.

For some perspective, take today’s chart which overlays the 24-month change in inflation-adjusted margin debt on top of the inflation-adjusted S&P 500.

Conclusion…

The stock market has tended to struggle soon after a surge in margin debt.

And…

Stocks have tended to rally soon after a significant contraction in margin debt.

What is margin debt?

Margin debt is money borrowed from a broker for the purpose of buying stock.

What is a margin call?

A margin call refers to a broker demanding that an investor deposit additional money into their margin account to meet the required minimum.