Are growth stocks or value stocks outperforming right now?

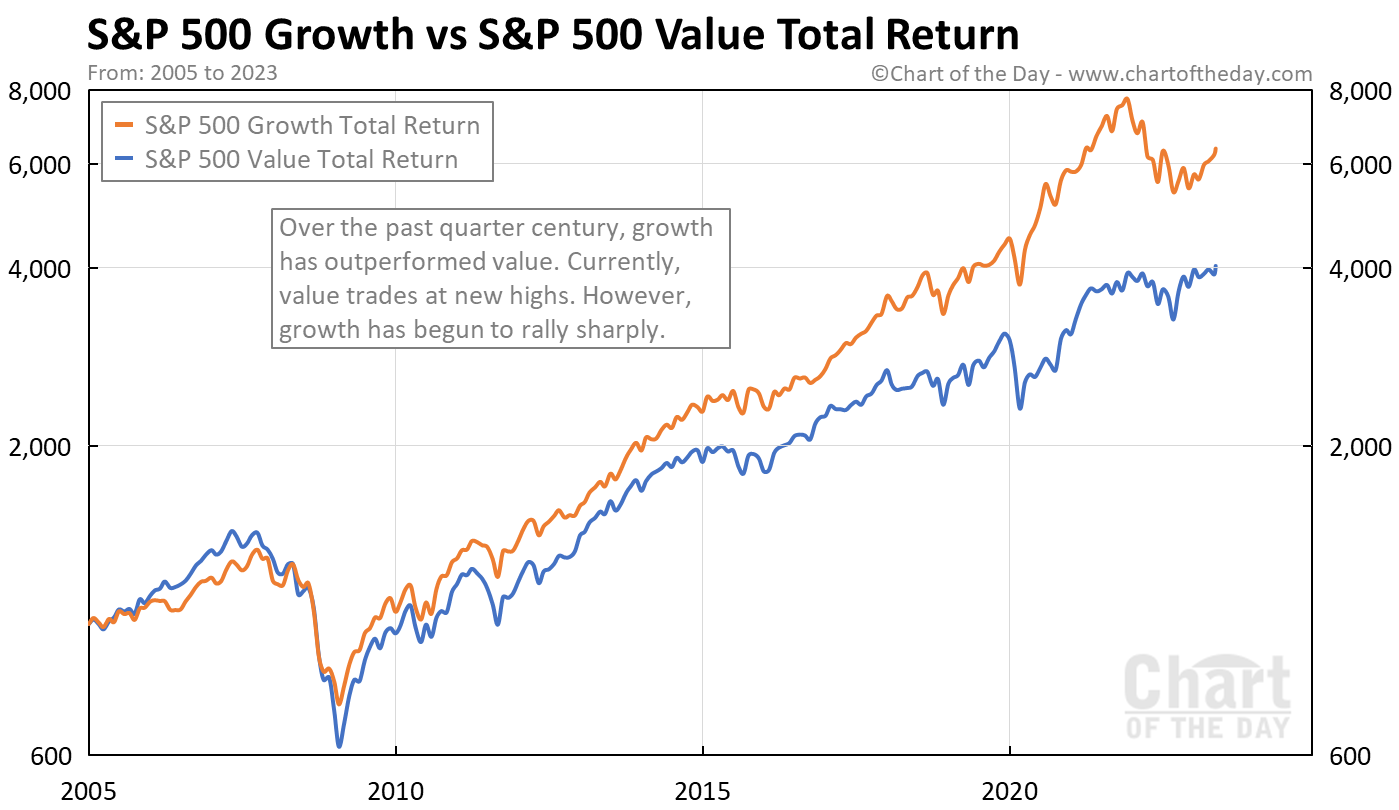

Today’s chart answers that question by presenting the total return trend for both the S&P 500 Growth Index and S&P 500 Value Index.

Today’s chart illustrates that, on a total return basis, growth stocks (orange line) have outperformed value stocks (blue line) since 2005.

More recently, while value has made new highs, growth has begun to rally.

What is considered a growth stock?

Generally, a growth stock is a share in a company that has above average earnings growth and has the potential to grow faster than the overall economy.

What is considered a value stock?

Generally, a value stock is a share in a company that is appears to be undervalued based on some fundamental criteria such as earnings, dividends, revenue, book value, etc.

What is the difference between large-cap and small-cap?

Market cap categories break down as follows: mega-cap ($100 billion plus), large-cap ($10 billion-$100 billion), mid-cap ($2 billion-$10 billion), small-cap ($300 million-$2 billion), and micro-cap (less than $300 million).

What is the S&P 500?

The S&P 500, short for Standard & Poor’s 500, is a market capitalization weighted stock index of 500 large-cap U.S. companies.