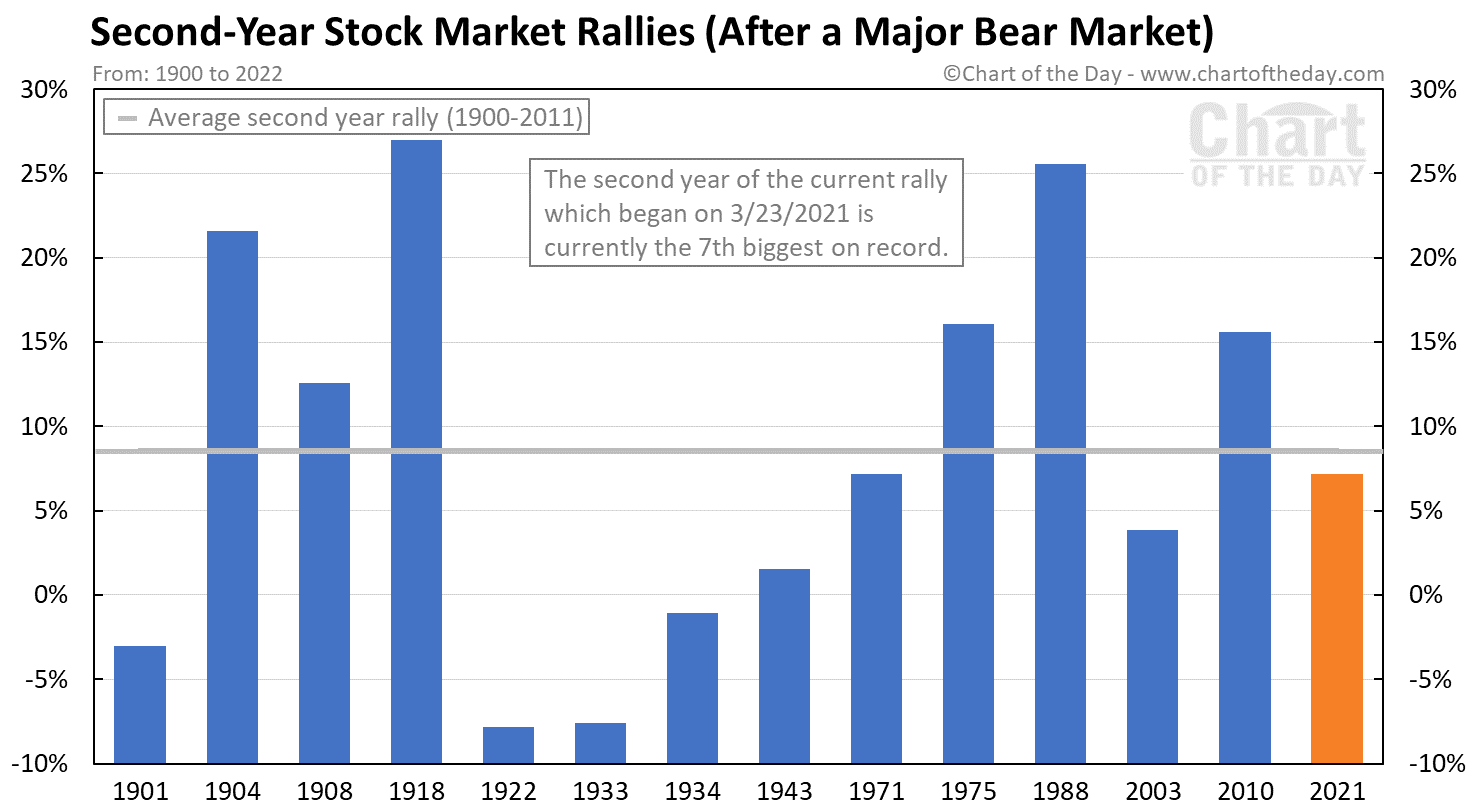

How does the second year of this post-major bear market rank?

Today’s chart answers that question by presenting the performance of the Dow during the second year after a major bear market trough (since 1900).

So how does the current rally compare?

If the second year of the current rally were to end today (orange column), it would rank as the 7th biggest since 1900.

Considering that there are only two days to go, this second year rally could be considered to be near average.

What is a bear market?

A bear market is typically considered a greater than 20% decline of a major stock market index such as the Dow or S&P 500.

What is a major bear market?

A major bear market is considered a 30% or greater decline of a major stock market index.

What is a stock market correction?

A stock market correction occurs when a major stock market index declines by 10% or more.

How frequently does a major bear market occur?

Since 1900, there have been 14 major bear markets or one every 8 1/2 years on average.