The stock market is up significantly following its March 2020 lows.

Why?

Massive government intervention.

And…

Hope. Hope that we will get through this crisis in the not to distant future.

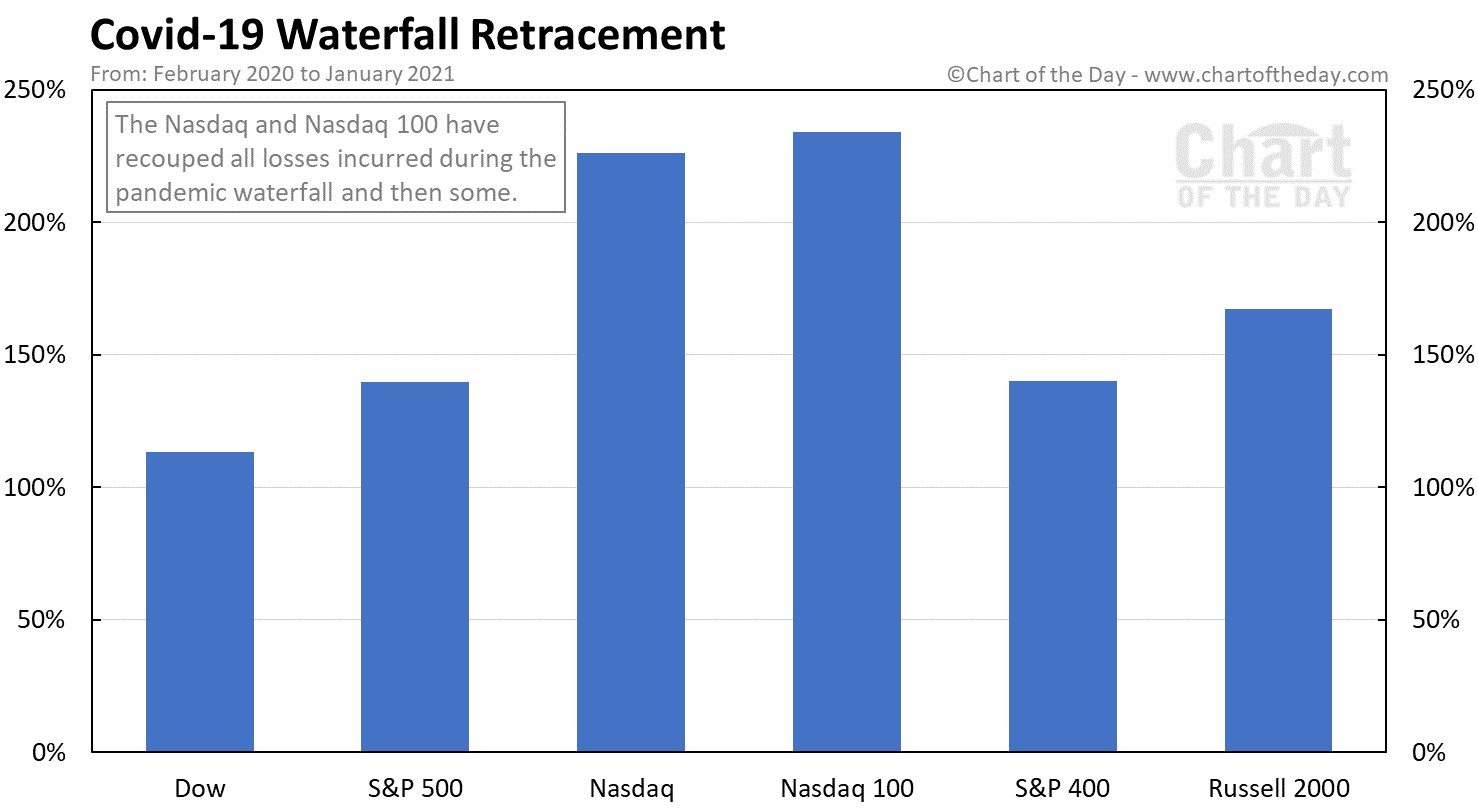

The chart below illustrates how much of the COVID-19 induced waterfall (i.e. a longer crash) has been retraced.

For example, a value of 100% means that the stock index is currently trading at its pre-pandemic peak.

What is a stock market waterfall?

While there isn’t an official definition for what makes a stock market waterfall. It is typically defined as a very sharp decline (e.g. >10%) in stock prices lasting from somewhere between a few weeks to a few months.

What is a stock market crash?

As is the case with stock market waterfalls, there is no official definition / threshold for what constitutes a stock market crash. However, stock market crashes tend to be dramatic stock market declines (e.g. <8%) over the course of one to a few days.

How many stock market waterfalls have there been?

The number of stock market waterfalls depends on how a waterfall event is defined. Generally, however, there have been approximately 20 waterfall declines since 1960 or one every three years. Though if a more extreme threshold were used, the case could be made that only 10 waterfall events occurred since 1960 or one every six years.

When did some of the more recent and extreme waterfall declines occur?

2020, 2018, 2008, 2002, 1987, and 1974