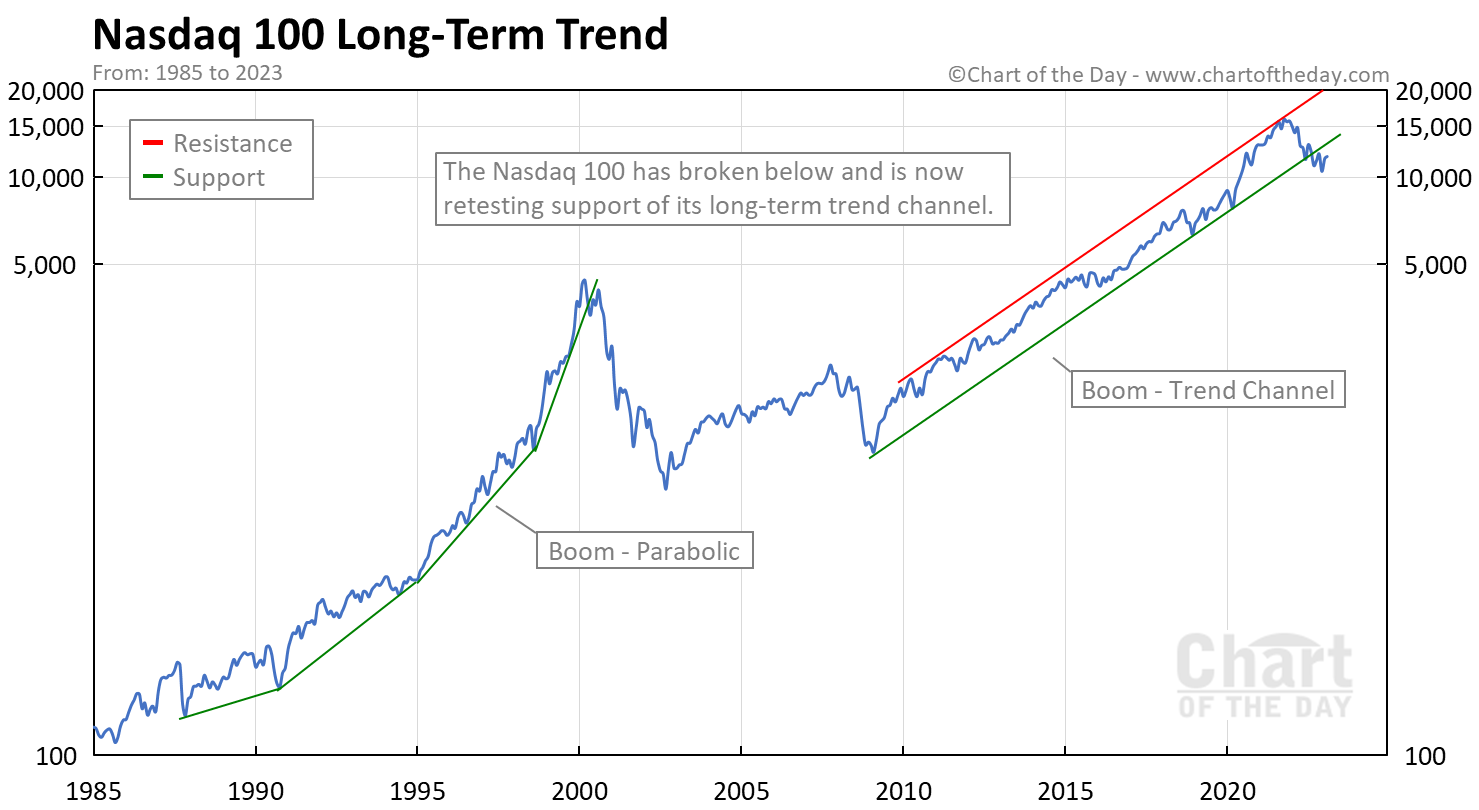

The Nasdaq 100 had been in a major bull market since the end of the financial crisis.

In fact, the Nasdaq 100 traded within the confines of a relatively narrow, upward sloping trend channel for over 12 years.

Shortly before and definitely after the Fed started raising rates — things changed.

During the summer of 2022, the Nasdaq 100 broke below support.

Currently, however, the Nasdaq 100 is testing what was once long-term support — for a second time.

What is the Nasdaq 100?

The Nasdaq 100 is a basket of the 100 largest market cap, non-financial stocks listed on the Nasdaq stock exchange.

When was the Nasdaq 100 initiated?

The Nasdaq 100 was initiated on January 31, 1985 at a base value of 125.

How is the Nasdaq 100 calculated?

The Nasdaq 100 is a modified market-capitalization weighted index.

What are the main sectors included in Nasdaq 100?

Over three quarters of Nasdaq 100 weighting comes from two sectors — technology and consumer services. The remainder of the index is made up of health care, consumer goods, industrial, and telecommunication companies.