How does the stock market perform after the Fed begins to raise rates?

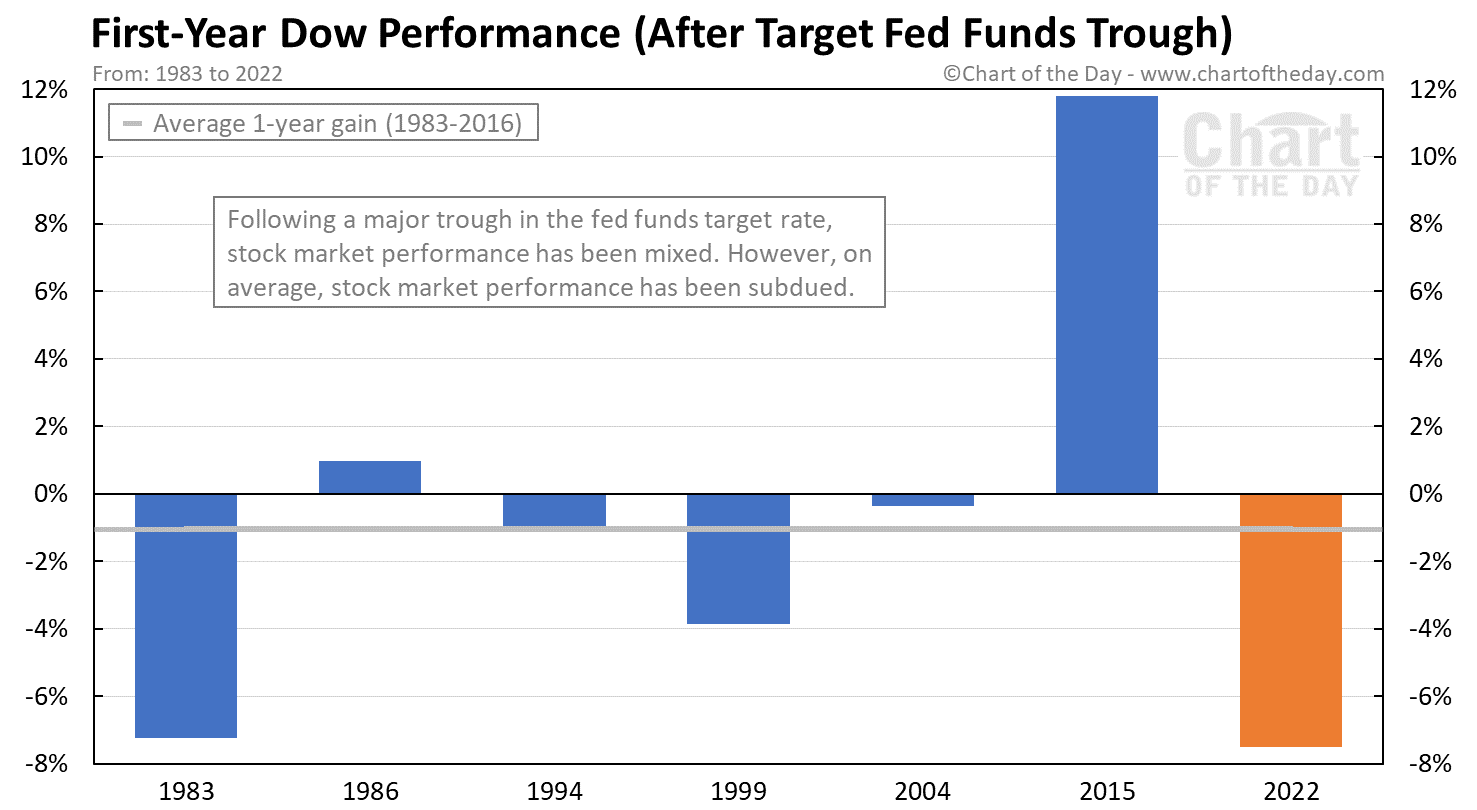

Today’s chart answers that question by presenting the performance of the Dow following a major fed funds target rate trough (since 1983).

As today’s chart illustrates, the Dow’s performance following a major fed funds trough has been mixed — ranging from -7% to nearly 12%.

It is worth noting that the average one-year gain has been -1%.

Less than ideal.

What was the highest fed funds rate?

The fed funds rate reached its record high of 20% in 1980 in an effort to counter double-digit inflation.

What was the lowest fed funds rate?

The fed funds rate dropped to 0.0% to 0.25% back in 2008 as a result of the 2008 financial crisis and hovered near the zero bound for the following seven years. The fed funds rate also dropped to 0.0% to 0.25% following the pandemic induced economic shutdown in 2020.