As a result of a whole host of issues (e.g., inflation, rising interest rates, war, endemic, etc.), the stock market has struggled.

In fact, the Dow is currently down more than 20% from its early January peak.

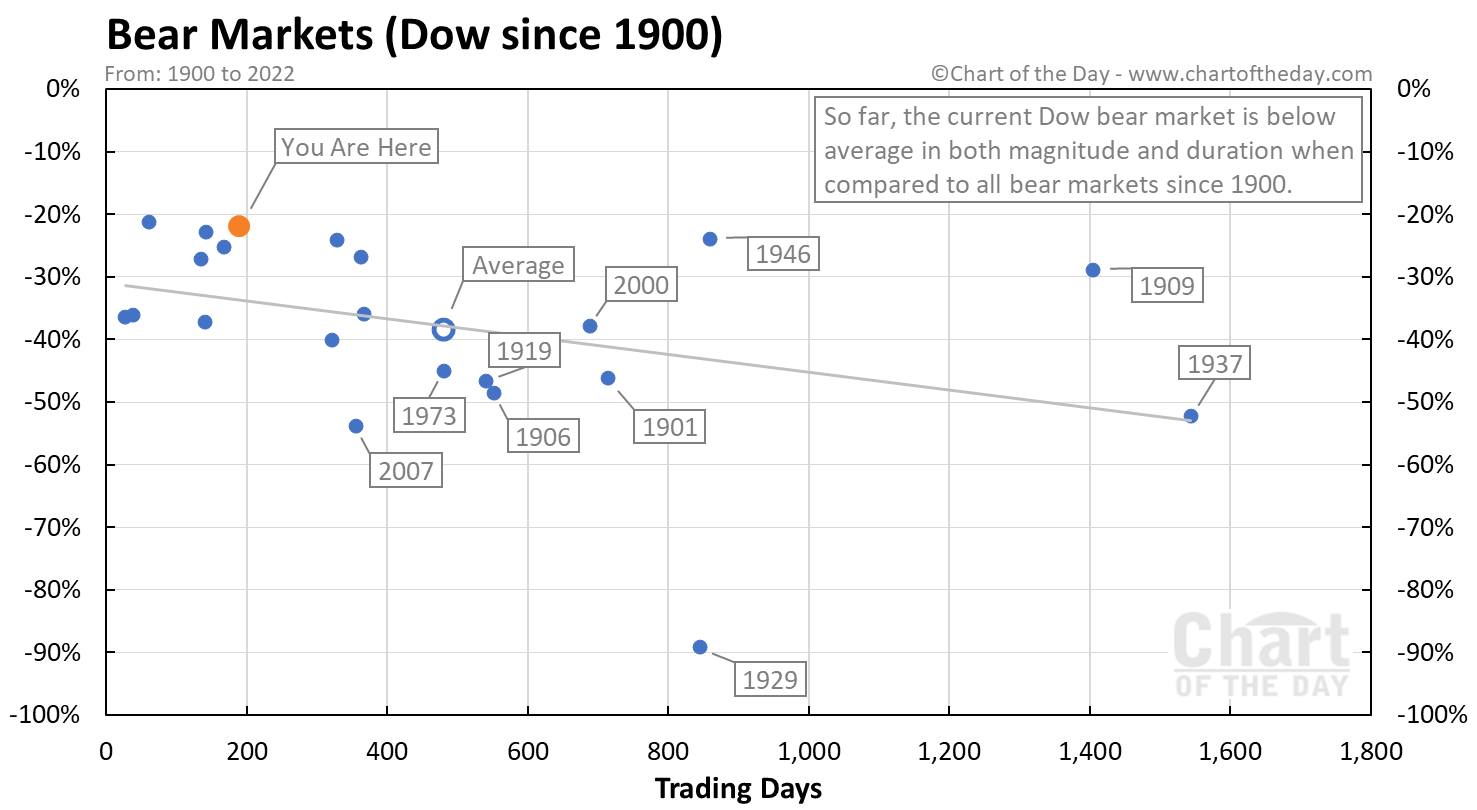

So how does the current bear market compare?

To answer that question, today’s chart presents the performance of the current bear market (orange dot) to all other bear markets since 1900.

Conclusion…

If the current bear market as measured by the Dow were to have already seen its low, then it would be classified as relatively mild.

It is worth noting, however, that most bear markets since the turn of the previous century (as well as the turn of the current one) have endured declines of much greater significance.

What is a bear market?

A bear market is typically considered a greater than 20% decline of a major stock market index such as the Dow or S&P 500.

What is a major bear market?

A major bear market is considered a 30% or greater decline of a major stock market index.

What is a major stock market correction?

While a stock market correction refers to a major stock market index decline of more than 10%. A major stock market correction ups that threshold to 15%.

How frequently does a bear market occur?

Since 1900, there have been 22 bear markets as measured by the Dow or about one every 5.5 years.